Legacy producers like Ghost Drops and Fritz’s are joining the legal cannabis market, helping make it even more vibrant. Discover their stories and celebrate the continuing evolution of Canada’s cannabis industry.

When the federal government announced in June 2018 that recreational use of cannabis would be legalized that fall, it was music to the ears of many — including cannabis entrepreneurs and producers who had been operating in the unregulated market, awaiting the day they could sell their products legally.

Not every company has made the journey from legacy to legal, but nearly four years into legalization, some of the most beloved, celebrated legacy cannabis brands have joined the regulated market — bringing with them years of experience, knowledge and some very fine cannabis products. (Lucky us!)

As we celebrate the continued evolution of Canada’s legal cannabis marketplace this Canada Day, we’re shining a light on the legacy-turned-legal Producers who are helping to make it even more dynamic and diverse. Here are some of their stories.

Dunn Cannabis

Logan Dunn was so eager to showcase his craft cannabis to consumers in the legal market, he applied for a micro-cultivation licence the first week he could.

“Before legalization, there was never really accountability, no one to tell you if your products were good or bad,” he says. After decades of honing his cultivation skills, he wanted to know what a wider audience of consumers would think. “And I wanted to make my mom proud.”

But navigating the process wasn’t easy. When Dunn Cannabis finally got the green light to operate in the legal market in the summer of 2020, the Abbotsford, B.C.-based company hit the ground running. With 20 years of experience running a lean cultivation facility with 74 unique genetics and high-quality yields, Dunn and his team got to work bringing their small-batch, hang-dried and hand-trimmed flower to consumers in a handful of provinces.

To bring Dunn products to Ontario, the company joined the BZAM family of brands late last year. Through that partnership, Dunn Cannabis products arrived in Ontario this spring with B.C. Valley Gas, a popular flower strain among B.C. consumers, with a fragrant, fuel-like aroma; Pink Velvet #44, a strain with a distinct terpene profile (and only 50 mother stock seeds); and Dunn’s personal favourite, a pack of seven pre-rolls featuring Acai Berry Gelato flower.

Though the journey from legacy to legal has been long, Dunn says it was worth it.

“The biggest advantage is that more consumers can get their hands on our craft cannabis products and enjoy the results of our hard work as much as we do,” he says. “I can build a business that’s real and forever — something I can hand down to my family. [It’s] a different kind of legacy.”

Dymond Concentrates 2.0

Founded in 2012, Dymond Concentrates 2.0 (formerly known as Diamond) quickly built a legacy-market following for its live resin, distillate, live rosin and vape pens. It was also one of the first pre-legalization brands to make shatter accessible to legal medical-cannabis consumers.

“Our grassroots efforts and cannabis community event participation helped us grow a tremendous following on our social media platforms and gain a lot of credibility in the industry,” says founder and CEO Len Atkinson.

Despite his underground success, Atkinson dreamed of one day bringing his product line to a legal marketplace. To his disappointment, when legalization did become a reality, concentrate products weren’t a part of the initial product offering. Instead, he’d have to continue refining his hydrocarbon-extraction techniques and wait for cannabis 2.0 — the second phase of legalization that would roll out in late 2019 and early 2020, introducing concentrates, edibles and topicals to the market.

“The increased level of scrutiny reassures us and our customer base that every time they buy Dymond Concentrates, they are getting the purest and most potent cannabis extracts in Canada”

Selling in the legal market was an adjustment, Atkinson says, but the cons — such as strict marketing rules — have been outweighed by the pros, like higher assurance standards that consumers can rely on.

“Hands down, the most appealing part of making the transition is gaining consumer confidence in the quality our products offer,” Atkinson says. “The increased level of scrutiny reassures us and our customer base that every time they buy Dymond Concentrates, they are getting the purest and most potent cannabis extracts in Canada.”

To bring its products to legal consumers, Dymond has partnered with companies like CannGroup to help with compliance and with JWC to assist with sales and distribution. Using what Dymond calls a “soil to oil” production process, the company has released strain-specific shatter, diamonds and live resin, as well as the first 0.8-g disposable (and rechargeable) caviar vape pen (best suited, Atkinson says, for consumers who are new to concentrates). Coming to Ontario later this year are infused pre-rolls containing strain-specific THCa diamonds, which Atkinson recommends for fans of flower looking for higher potency.

Many of Dymond’s loyal legacy consumers have followed the company to the legal market, where its products are finding new fans, too.

“Being a well-established legacy brand, we have definitely found our reputation has assisted us,” Atkinson says. “Store owners and budtenders that are familiar with our legacy success [feel confident] carrying our brand for their customers.”

Fritz’s Cannabis Company

“Small businesses are finding ways to make it work because of their commitment to and love for the cannabis plant”

The brainchild of Tabitha Fritz and Ari Cohen, Fritz’s edible products were born in a Toronto kitchen in 2015, intended for smoke-free friends and medical consumers looking for smoke-free options. When the company started selling at a popular Toronto pop-up for not-yet-licenced cannabis brands, their fruity infused soft chews quickly became a favourite among a broad group of consumers.

Though they were successful in the unregulated market, Fritz and Cohen always wanted to eventually become a legal company. “Both Ari and I have a pretty high risk tolerance, but it’s difficult to find your balance when you’re making a product that you believe in that is still technically illegal,” Fritz says. “We hoped that we would eventually have an opportunity to move to the regulated space but we didn’t know how long it might take us.”

The opportunity arrived in 2020, when Licensed Producer Medz agreed to lease production space and work with Fritz’s so they could finally make the transition. Today, a variety of Fritz’s edibles — created using the same recipe that helped them build a reputation in the legacy market — are available in Ontario’s regulated market.

Fritz says the transition has allowed for greater accountability, higher standards for product inputs and a heightened sense of security and confidence (no need to worry about police knocking on the door). But it has also meant navigating the legal framework, which limits edibles to a maximum of 10 mg THC per package. (Fritz says many legacy consumers were used to purchasing much higher-potency edibles.)

Ultimately, she’s happy to see self-funded legacy entrepreneurs like Cohen and herself finding their way into the regulated market.

“Legacy entrepreneurs or small businesses [don’t] have an easy path towards profitability,” Fritz says. “But despite that, we see that those entrepreneurs and small businesses are finding ways to make it work because of their commitment to and love for the cannabis plant.”

Little Farma – Sherbinskis – Flir — Blessed

“Out of the shadows, into the light” is the tagline of B.C.-based legacy brand Little Farma. In the early days of legalization, that was easier said than done.

“When legalization was first announced back in 2018, we found it very difficult to transition,” says co-founder Dome Duong. “There was so much taboo if you had been doing business in the legacy market and so much uncertainty on how you were going to transition. We found it took a lot of patience and time to align with the right strategic partners.”

The right partners finally came along; Final Bell, a company specializing in helping cannabis brands commercialize their products, was one of them. Final Bell’s roster of clients includes well-known brands in the legal cannabis marketplace, but it’s also helping many beloved legacy brands make the transition — including Sherbinskis, a cult favourite flower brand, and Blessed and Flir, both legacy edible producers.

“We want to partner with brands that have an impact and that we believe will resonate with consumers,” says Final Bell CEO Greg Boone. “These brands will have traction or a vision that is compelling and have the potential to scale, or can remain small and boutique but are of the highest quality and appeal to true connoisseurs.”

Sherbinskis recently launched a live resin disposable pen in Ontario and will soon be launching products in other categories. Founder Mario Guzman says the partnership with Final Bell has helped him achieve his goal of bringing his products to as many people as possible.

“The amount of [market] penetration that we’ve been able to achieve in a short time is a testament to the strength, depth and vibrancy of the Canadian legal market,” Guzman says.

It’s also testament to the quality and diversity of products coming to market, including those from legacy brands — like the infused artisan chocolate created by Flir, formerly E/P Infusions in the legacy market.

“I think the only way to build a brand that’s authentic is to follow a personal vision of what’s missing from the world that you wish to see and to go out and make it a reality,” says chocolatier and Flir founder Riley Starr. “That was true for me in the legacy market, and even more so now in the legal market.”

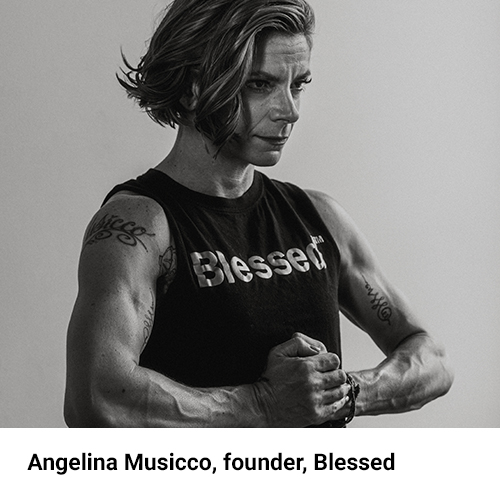

Angelina Musicco also found edibles success in the unregulated market with her Blessed chocolates. Now with a foothold in the legal market, Musicco’s hope is that the 10-mg THC limit on edibles will be increased, which would help retain the loyal customers she reached previously.

“My legacy fan base has waited a long time for these chocolates to arrive and I’m forever grateful for their patience,” Musicco says. “The THC milligram dosage for our Blessed chocolate bar is different from our legacy-market bar, but the energy remains the same. We hope to continue the conversations of upping the THC dosage for edibles.”

Ghost Drops

Toronto-based cannabis brand Ghost Drops launched just one year before legalization, but that was enough time to build a dedicated following — one that was incredibly excited when the company dropped its first product in the Ontario legal marketplace earlier this year.

“I can tell you for sure that most, if not all, of our legacy fan base has followed us into the legal market,” says CEO Gene Bernaudo, who joined the company in June 2021. “We hear from them every day. They mostly offer words of encouragement, thanking us for bringing quality product to the legal market and ultimately making it easily accessible. At the same time, they are the most critical consumers and are the first to point out if we missed something.”

The access to more consumers is one upside of selling in the legal market, Bernaudo says, though marketing to them is more challenging due to advertising restrictions. “I think this is something that needs to change, and Ghost Drops is the brand that will push limits,” he says.